BLOG

Optimizing the invoice receipt process in 3 steps: receiving invoices by email

A not-insignificant proportion of small and medium-sized companies in Germany have already taken their first steps towards digital transition.

This affects digital incoming invoice processing in particular. The benefits when it comes to gains in efficiency are particularly clear. Two parties are always part of process optimization when it comes to accounting – the invoice issuer and the invoice recipient. So, what do you do when the invoice issuer is still relying on good old snail mail – and just doesn’t like sending out its invoices by email? In this article, we’ll show you three steps to put the right incentives in place so that you and your invoice issuer can take this step together.

Invoicing by email can provide 100% automation

You’re there with your fully-developed digital invoice receipt system but you still can’t show off all its benefits – all too many incoming invoices are still turning up in paper form in your post room. That is an adequate description of the “problem”. For the sake of completeness, I’ll take this opportunity to go over the situation again.

Convincing suppliers about invoicing by email

This doesn’t just disadvantage the invoice recipient – it also disadvantages the invoice issuer. The problem is more or less the same on both sides. Just like invoices can’t get into envelopes by themselves and ship themselves off, the invoices letters can’t open themselves or automatically take the incoming invoices contained within to be scanned in. In other words: staff on both sides deal with these routine tasks – which costs time and money and can annoy the staff every now and then.

Perhaps an example calculation to demonstrate financial reasons for why you should back invoicing by email:

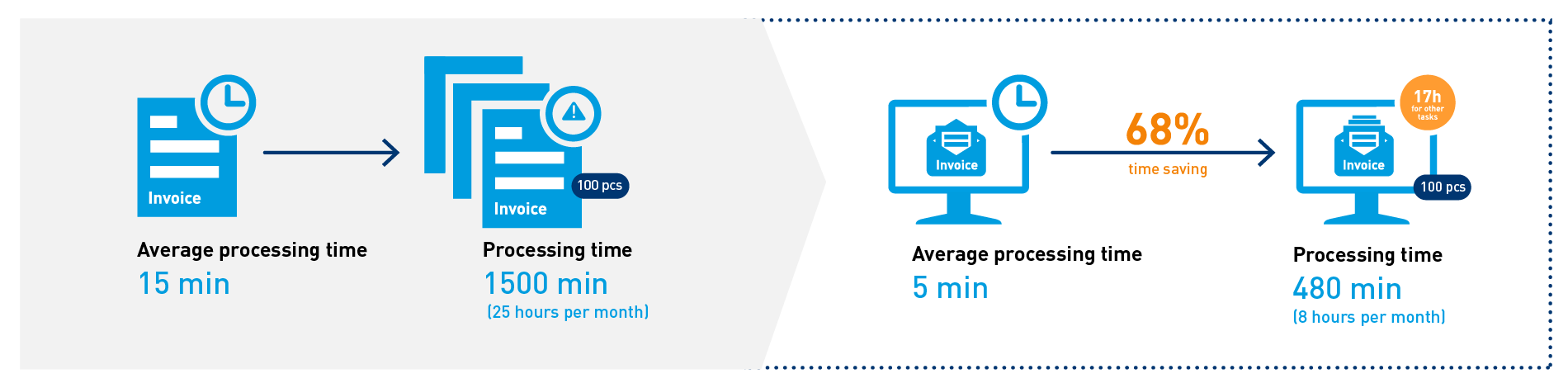

Factoring in an average processing time of 15 minutes per invoice, if you get 100 invoices per month, that’s 25 hours (1500 minutes) of processing time. If you reduce the processing time to 5 minutes simply by using invoices by email, you’ll only need about 8 hours for 100 invoices. That means you’re making 17 hours available for your staff to do more productive things. It should be noted we haven’t even touched on costs arising for ink, toner, paper and postage, all of which would fall away when emailing invoices.

Receiving – and enjoying – invoices by email…

Convince your invoice issuers of the benefits of electronic communication, especially with regard to sending invoices by email. Unfortunately, even in 2020, there are still concerns and biased opinions regarding digitally sending outgoing invoices which then become incoming invoices for the invoice recipients – i.e. for you.

Worries, concerns, fears regarding invoicing by email…

In many places, there is still the preconception that electronic outgoing invoices are disadvantageous for the invoice issuer. A key idea here being “no input tax deduction”, etc. That is not the case. Since the restructuring of the Tax Simplification Law (DE) in 2011, these fears are no longer justified. Quite the opposite: The central element of this “restructuring” for electronic invoicing is that it allows the invoice issuer

- to choose both the invoice format

- and the method of transmission

So long as the mandatory information for an invoice is included, it should be added. So, you’re free to send or receive an invoice by email as a PDF attachment, an invoice in XRechnung or EDI format, by fax or by web upload. The possibilities are limitless.

We should also consider that the invoice recipient must also agree to receive their invoice by email beforehand. However, you don’t have to wait for the recipient’s consent. You simply rely on so-called “implied declaration of consent” – that means: once the recipient of the email pays the invoice, this counts as consent.

How can you make your distribution invoices by email palatable to your invoice issuers? Show them the benefits! Everything else then practically falls into place.

1. Receiving invoices by email – agreements

As a first step, you should give your suppliers and invoice issuers a clear demonstration of the benefits arising from sending invoices by email. In brief:

- The legal situation regarding sending invoices by email has been cleared up, see simplifying electronic invoicing. The use of digital signatures or electronic signatures has not been required to send invoices by email for a while now.

- The quicker the outgoing invoice gets to the invoice recipient by email, the sooner the invoice issuer receives payment – and if that isn’t attractive, what is?

- Point to the fact that it is also simpler and quicker for the invoice issuer to create an invoice as a PDF and send it by email.

- Invoicing by email also ensures lower costs, e.g. for postage, paper, printer ink / toner and folders

- Minimizes the space required for storing paper records

- Easier to compare invoices

- You also gain access to larger business partners by invoicing by email

It’s clear that you can’t force anyone to be happy. However, the benefits mentioned are clear – for both parties. Tell your invoice issuers that they’ll love invoicing by email too – even if changing traditional processes isn’t easy to start with.

2. Receiving invoices by email: formats

First off, the invoice can be attached to the email and then sent, received and processed in common formats. PDFs, TIFFs, JPGs, etc. are on offer as common and unstructured invoice formats.

That means you don’t need to worry whether your emailed invoice can be processed. After all: contemporary incoming invoice processing software usually has a high-performance Optical Character Recognition (OCR) module. That means that, shortly after the invoice arrives by email, the relevant invoice data can be extracted by the incoming invoice software and squared using ERP systems, etc.

3. Receiving invoices by email: adhering to conventions

Obligation is followed by freestyle: to start off with, it’s sensible for the invoice recipient to receive all their emailed incoming invoices on one specific email address. Invoices sent by email will then go to a catch-all inbox for incoming invoices, e.g.: . Give this email address to your invoice issuers.

Other helpful steps include adhering to specific conventions in your email headers: only the following information regarding the invoice attached to the email should appear in the email subject line:

- Invoice: Invoice number, cost center

No other information about the invoice should then appear in the body of the email. The body of the email should be sent without text as this part of the email is not evaluated.

Everyone benefits from invoicing by email

If you have convinced your suppliers and invoice issuers of this idea, the emailed invoices can be processed automatically. The entire incoming invoice process can be sped up significantly using the agreements just mentioned. Fully-automated accounting is possible this way too. This makes a crucial difference within procurement processes in particular. You will love it.

In the next part of this article, you’ll learn more about more recent developments in the field of electronic invoice processing, about invoice formats and about transport routes (records) – things will stay exciting.